The GST payment challan also known as GST PMT-06 is a single challan that taxpayers can use to make a variety of GST-related payments such as payment of tax dues, penalties, fees, interest, etc. Let us understand this by taking an example.

| Output | ||||

| IGST | CGST | SGST | Sum | Total Amount |

| 68,057.25 | 290,338.95 | 290,338.95 | Add (+) | 6,48,735.15 |

| Input | ||||

| 74,459.23 | 74,459.23 | Less (-) | 1,48,918.46 | |

| GST RCM | ||||

| 2,175.63 | 2,175.63 | Add (+) | 4,351.26 | |

| GST Payable | ||||

| 68,057.00 | 218,055.00 | 218,055.00 | Total | 5,04,167 |

| Interest | ||||

| 537.00 | 1,721.00 | 1,721.00 | 3,979 | |

| Total GST Payment |

5,08,146 | |||

Follow the Below steps to pass the entry:

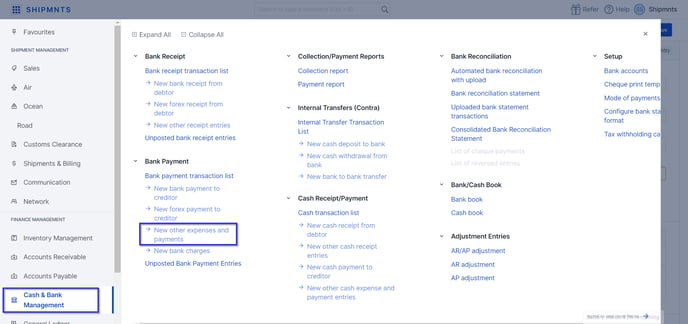

- Go to Cash & Bank Management

- Click on "New other expenses and payments" (Refer to screenshot 1)

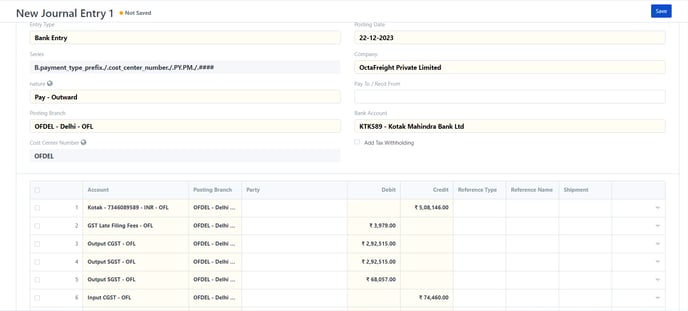

- Select Posting date on which GST challan payment is made (Refer to screenshot 2)

- Start adding the accounts and amounts (Refer to screenshot 2)

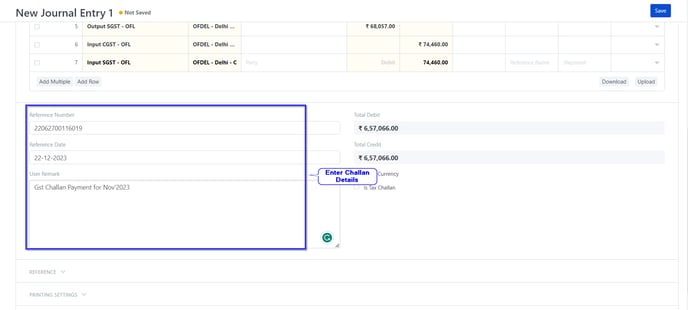

- Add GST challan details (Refer to screenshot 3)

- Save and Submit the entry

Select the Bank account from which GST payment is done

Screenshot 1

Screenshot 2

Screenshot 3